Table Of Content

Be sure you're comfortable with the contingencies and are confident any actions you take won't result in losing your good faith deposit. Earnest money isn't always a requirement, but it could be a necessity if you're shopping in a competitive real estate market. Sellers tend to favor these good faith deposits because they want to ensure that the sale won't fall through. Earnest money can act as added insurance for both parties in the transaction. This article will provide an overview of what earnest money is, how to use it to your advantage when buying a house and how to protect yourself once you deposit it.

Cost Factors to Build a House in California

Down payment for a second home in Canada: How much do you need? - MoneySense

Down payment for a second home in Canada: How much do you need?.

Posted: Fri, 03 Nov 2023 07:00:00 GMT [source]

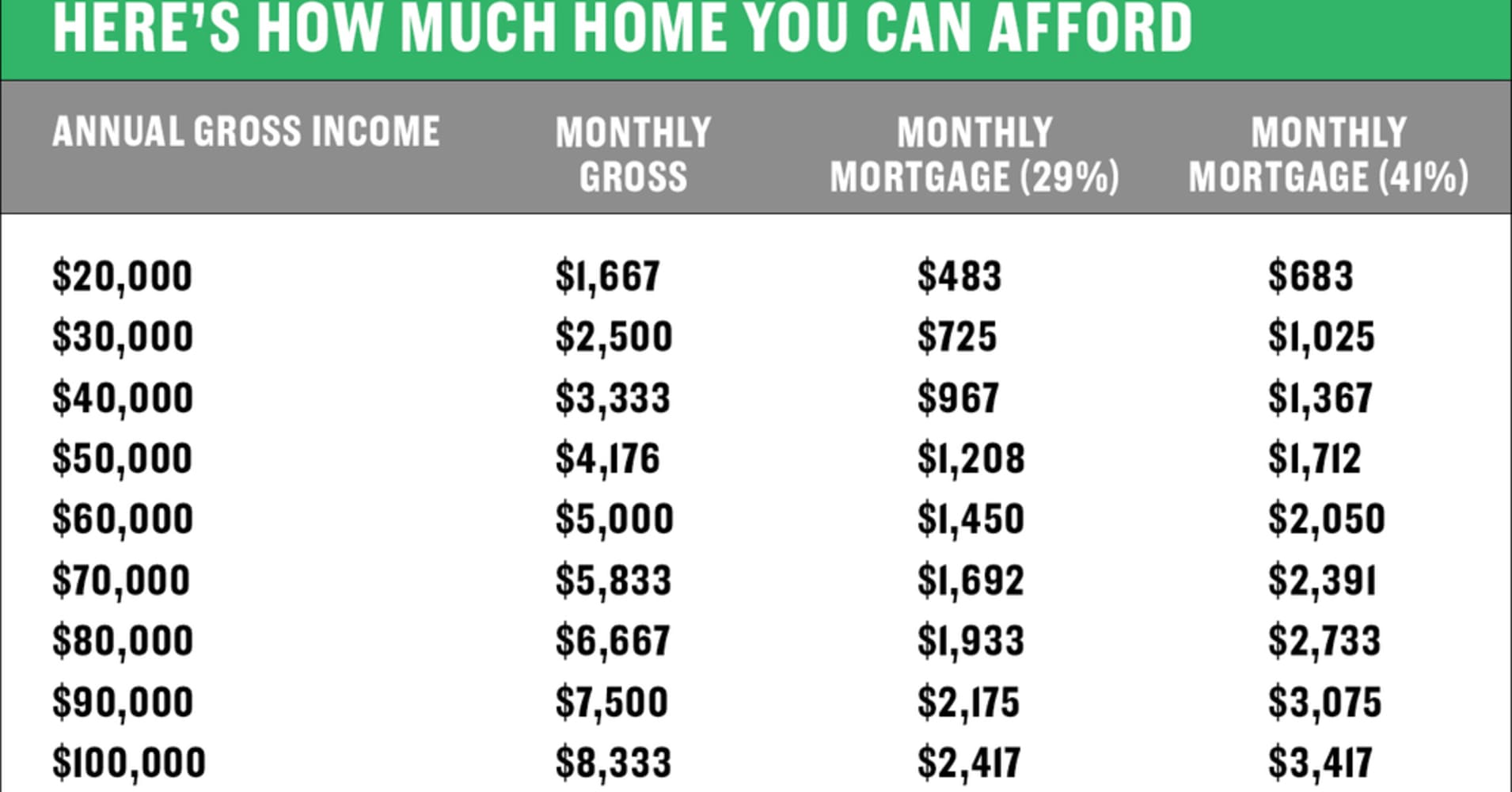

A down payment shows lenders that you’re serious enough about home ownership to invest your own savings in the property. Your investment helps demonstrate that you think the property is a wise purchase and that you’re committed to paying the mortgage you’re asking for. No rational person will throw their savings at a property they think is worth less than the asking price or that they plan to abandon if times get tough. If you’re looking to make a minimum down payment of 3%, you’ll likely need to make more than $100K per year to afford a $500K home. However, if you can manage to put down at least 20%, it’s possible that you could afford a $500,000 home on a $100,000 annual income. But it will depend on the level of other debts you already have.

How much down payment do you need for a house?

Depending on the type of home loan, your down payment could be as low as, well, nothing. Therefore, the amount you should put down on a house depends on your personal finances. So explore all your options and find the right down payment amount for you. Not everyone can easily afford 20% down, especially with home prices having risen at a record pace over the last few years.

Fixed-Rate & Adjustable-Rate Loans

We’ll help you understand the true cost of your mortgage and identify the best loan options for you. Consider your loan requirements, financial situation and individual preferences when deciding how much you need for a house down payment. You can save thousands of dollars over time by reducing the amount of money you borrow and the interest you pay on the mortgage loan. Let’s look at the typical down payment requirement for different loan types. We’ll also discuss the average amount buyers pay upfront so you can get an idea of what to expect on your journey toward homeownership. The median down payment on a home in the U.S. was $51,250 as of December 2023, according to real estate data provider ATTOM, an 8.6 percent increase year-over-year.

California Ranch

The minimum amount you can put down will depend on the type of mortgage you get. For example, you’ll typically need to put at least 3% down for a conventional loan or 3.5% down for an FHA loan, while USDA and VA loans don’t require a down payment. Half of the cost to build a house in California will come from the materials. However, the overall cost will vary based on the size of the home and the quality and type of materials you choose throughout the build process.

Average Down Payment by State

It’s also a rule that most programs charge mortgage insurance if you put less than 20 percent down (though some loans avoid this). Down payment options for major loan programs range from zero to three, five, or 10 percent. A smaller down payment allows you to enter the housing market sooner, as you don’t need to save as much money before purchasing a home. This can be especially helpful for first-time home buyers or those with limited financial resources. Lower upfront costs also mean you may be able to afford a larger or better-located property than if you had to save for a larger down payment.

Rocket Sister Companies

Since lenders look at DTI to make lending decisions, having a high DTI can keep you from qualifying for other loans in the future. PMI can be a helpful tool to make homeownership a reality for anyone who might struggle to save a 20% down payment. But it is a monthly cost in addition to your mortgage, and unlike your mortgage payments, PMI payments will not help you build equity in your home. In fact, many people do put down less than 20% when buying a home.

For the most common types of mortgages, lenders charge premiums when you put less than 20 percent down. With a larger down payment, you won’t have to borrow as much mortgage to complete the purchase of your home. On the surface, this means you’ll have a lower monthly mortgage payment and save real money on interest charges. This also might keep you from taking on more debt than you can handle.

How Much Does It Cost to Build a House in California?

Make sure the purchase agreement lays out who gets the earnest money if the contract is canceled. As a result, you should never give your earnest money directly to the seller or a real estate brokerage. Instead, go with a third party such as a title or escrow company, which will hold your earnest money for you.

In Fresno, the land prices are lower than in the rest of the region, with typical land listings priced at around $160,000. In San Francisco, you can expect to pay an average of $2 million for a typical land listing. You'll need to consider several factors beyond your typical construction costs. You need land for the property, and California has some of the most expensive land values.

However, the USDA counts 97% of America’s landmass as rural, including some suburbs. So, look up the address of the home you want to buy on the USDA’s website to see if your next home might be eligible. An even bigger source of down payment funds can be down payment assistance (DPA) programs. And there’s a whole section of these coming up later in this article. Ask lenders what information they need from you to issue a mortgage preapproval letter, and confirm that you have the documents on hand. Here are some factors that can influence the interest rate you’re offered.

No comments:

Post a Comment